Planning for retirement is one of the most important financial decisions people make in their lifetimes. With so many investment options available today, from traditional stocks and bonds to alternative asset classes like gold and fractional art investing, knowing where to start can feel overwhelming at times. In this article we’ll explore both traditional and alternative retirement investments, outline how they work, their pros and cons, and how each can fit into a diversified retirement portfolio.

Traditional Retirement Investments

Despite the emergence of a multitude of new investment types in recent years, traditional investments like stocks and bonds remain the foundation of most retirement portfolios. They are well-regulated, widely understood, and offer a range of options to match risk tolerance and time-horizon.

Stocks (Equities)

Stocks represent ownership of a share in a company, and are one of the most common growth-focused investment types. Buying stocks means the investor owns an equity stake in the company. Each share corresponds to a portion of the company’s ownership, assets, and earnings.

Pros:

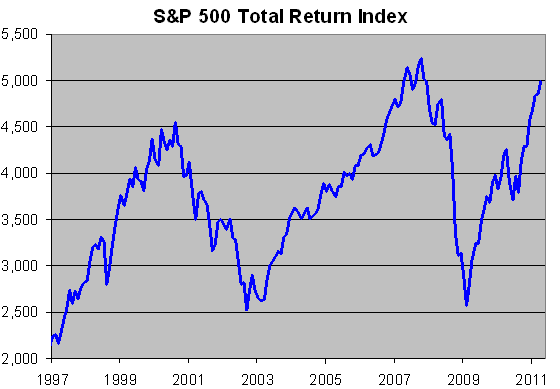

- High potential returns: Despite their volatility in the short-term, stocks have historically outperformed most other asset classes over the long-term, making them a cornerstone of growth-focused investment strategies.

- Dividend income: Many companies pay dividends, providing shareholders with a steady stream of income.

- Liquidity: Stocks are generally easy to buy and sell on exchanges, and can often be converted into cash quickly at the prevailing market price (although liquidity may vary for smaller or less-traded stocks).

Cons:

- Market volatility: Stock prices can fluctuate significantly in the short-term, and may even fall dramatically during major economic events such as 1987’s Black Monday which saw a single-day market drop of over 20% and the Dot-Com Crash of 2000 which wiped-out much of the value of technology stocks at the time.

- Emotional risk: Excessive exuberance and fear can lead to poor investment decisions.

- Research & monitoring: Investing in individual stocks requires researching factors such as company earnings and management quality, as well as regularly monitoring the company’s performance over time.

Bonds

Bonds are loans to governments or corporations that pay interest over time. They’re traditionally viewed as a safer, more stable counter-balance to stocks. When investors buy a bond, they’re essentially lending money to a government, municipality, or corporation. In return, the issuer promises to pay interest (called a coupon) at fixed intervals, usually annually or semi-annually, until the bond matures. These periodic interest payments are called “coupon payments” because in the past investors literally clipped coupons from paper bonds to redeem the interest. At maturity, the investor receives back the “principal” which is the face value of the bond.

Pros:

- Predictable income: Most bonds pay regular interest (coupon payments), which can make them ideal for retirees seeking a steady income stream.

- Less sensitive to market sentiment: Whereas equities reflect expectations about a company’s future profits and growth (expectations which can change rapidly and cause large price swings), bonds are mostly influenced by interest rates and credit risk which tend to change more gradually.

- Diversification: Bonds are a core diversification tool in portfolio management. Bonds can help balance a stock-heavy portfolio while still investing in regulated securities. For example, in the United States bond issuance and trading is overseen by the Securities & Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Cons:

- Lower returns: While bonds are typically more stable, their overall returns are often lower than those of equities. Based on long-term averages, historically stocks have delivered higher total returns than bonds: roughly 9–10% per year versus 5–6% for bonds in U.S. markets.

- Interest rate risk: Bond values fall when central banks raise interest rates. This happens because newly issued bonds pay a higher coupon based on the new higher interest rate, making older bonds paying a coupon based on the previously lower interest rate less attractive.

- Inflation risk: Most traditional bonds pay a fixed amount of interest (the coupon) at regular intervals. This payment does not increase with inflation unless the bond is specifically inflation-protected. Therefore, the coupon payments from bonds with a maturity date far into the future can lose purchasing power over time.

Annuities

Annuities are insurance products primarily offered by large insurance companies that provide guaranteed income for a specified period in exchange for a lump-sum payment.

Pros:

- Income: They can provide guaranteed income for life in some cases.

- Customizable: Annuities can be structured to suit individual needs. Options exist for returns which are fixed (providing predictable payments), variable (payments depend on the performance of underlying investments and can therefore fluctuate), or linked to inflation (to help maintain purchasing power over time).

- Protection from market volatility: Fixed annuities provide predictable income, shielding retirees from stock market volatility, economic downturns, or short-term fluctuations.

Cons:

- Complexity: The terms of annuities (e.g. complex fee structures and payout formulas) can be difficult for some investors to understand and compare to other types of retirement investments.

- High fees: Commissions and surrender charges can be steep in some cases.

- Limited liquidity: Funds are often locked in for years.

Mutual Funds

Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other assets. They can be actively managed by professional fund managers, or passively managed to track a market index like the S&P 500. If an investor wants to redeem shares in the mutual fund, they do so directly with the fund company (or via their broker) rather than selling them on an exchange. Mutual fund share prices are based on the Net Asset Value (NAV) of the fund, rather than real-time trading prices listed on an exchange.

Pros:

- Diversification: Risks are reduced by spreading investments across sectors or asset types.

- Professional management: As they’re managed by professional fund managers or designed to track an index, they can be ideal for busy professionals who prefer a hands-off approach.

- Tax advantages: In some jurisdictions, mutual funds have beneficial tax treatment. For example, in the United States investors can hold mutual funds in retirement accounts such as 401(k)s and IRAs.

Cons:

- Fees: Mutual funds generally have higher fees due to management and operating costs, and even performance fees in some cases.

- Limited control: Investors can’t choose specific holdings. The investments which are selected to be included in the fund are determined by the fund’s managers.

- Market exposure: Even though shares in mutual funds are not traded on exchanges, the price of shares in the fund are still subject to fluctuations in the broader market.

Exchange Traded Funds (ETFs)

Similar to mutual funds, ETFs pool investors’ money into diversified portfolios. The key difference is how they’re traded. ETFs trade on stock exchanges throughout the day, with prices fluctuating based on supply and demand. Unlike mutual funds, shares in ETFs are not bought or redeemed at Net Asset Value (NAV), although their market prices generally stay close to the fund’s NAV.

Pros:

- Diversification: Like mutual funds, ETFs invest in a diversified portfolio of stocks, bonds, or other assets. This can help reduce risk by spreading investments across many sectors or asset types.

- Professional management: As they’re also managed by professional fund managers or designed to track an index, this can make them another ideal option for those who prefer a more hands-off approach.

- Lower fees & minimum investment: Whereas mutual funds often require a minimum investment (typically between $500 and $3,000), ETFs can be purchased one share at a time. ETFs also generally have lower fees,, especially ones that track an index.

Cons

- Fluctuating market prices: Even though their market prices generally stay close to the fund’s NAV, market prices can still diverge from NAV. When this happens, the ETF can trade on an exchange at market prices which may temporarily be above or below the value of the fund’s underlying assets. This can mean investors pay more when buying ETFs (or receive less when selling) than the portfolio is fundamentally worth.

- Not all ETFs are low-cost: Many investors assume ETFs are always cheaper than mutual funds, but this is not always the case. Actively managed ETFs, commodity ETFs, and niche sector ETFs can carry significantly higher fees, sometimes even exceeding those of comparable mutual funds. This can make these ETFs inappropriate for long-term retirement investing.

- Complexity & risk: Although index ETFs are relatively easy to understand, certain ETF categories behave in ways that are difficult for many investors to understand, such as synthetic ETFs using derivatives, leveraged ETFs, and inverse ETFs.

Alternative Retirement Investments

Although traditional investments such as stocks, bonds and mutual funds still remain the foundation of most retirement portfolios, major economic events such as the 2008 financial crisis caused many investors to question how safe and reliable traditional finance truly is. This has led some investors to look at alternative investments to help diversify their savings beyond traditional finance.

Post-2008, investor demand for alternative investments has increased significantly. Even pension funds and endowments have been allocating more to non-traditional assets including commodities and hedge funds, precisely for the purpose of diversification to reduce overall portfolio risk by including assets that move independently of traditional markets. Alternative assets often react differently to economic shifts, inflation, and interest rates, providing uncorrelated returns that can help smooth-out volatility and sometimes even enhance long-term performance.

Commodities

Commodities are physical goods, the trade in which is fundamental to the global economy. Commodities can include precious metals like gold and silver, energy resources such as oil, and even agricultural products like wheat and coffee. Unlike stocks or bonds, commodities derive their value from real-world supply and demand. This makes them a distinct asset class, and can provide a hedge against inflation and instability in other markets.

Pros:

- Inflation protection: Commodities often rise in value when the dollar weakens.

- Diversification: Low correlation with stocks and bonds.

- Safe haven: Gold, in particular, is viewed as a store of value in uncertain times.

Cons:

- No income: Commodities don’t generate dividends or interest.

- Volatile prices: Even though they may move independently of stocks and bonds, prices are still Influenced by supply, demand, and geopolitical events.

- Storage & complexity: Physical assets such as gold can involve storage costs, and futures contracts (e.g. agricultural futures in wheat or coffee) can be complex.

Art

Although investing in famous artwork has historically been the exclusive domain of a wealthy elite, this has now begun to change. A growing trend known as fractional art investing has been opening the art world to everyday investors, allowing them to own a portion, or “fraction”, of prestigious masterpieces.

Pros:

- Diversification: Art has historically shown a low correlation with traditional financial markets. High-quality, blue-chip artwork has often maintained value during stock market downturns, which can help diversify a portfolio and spread investment risk.

- Professional expertise: Platforms employ art market specialists who conduct due diligence and authentication, reducing the risk of fraud.

- Prestige and emotional return: Owning a piece of a Picasso or a Monet can be incredibly enjoyable and carries emotional value beyond financial returns.

Cons:

- Valuation challenges: Unlike publicly traded stocks which have universally agreed prices listed on exchanges, art values are subjective and often based on auction results and the appraisals of experts.

- Market volatility: While art can hedge against the volatility in other markets, the value of art is influenced by what is fashionable, changing tastes, and collector demand.

- Liquidity: Converting art into cash can be challenging. Even if it’s in the form of shares in masterpieces via fractional art investing platforms, it can still be more difficult to sell shares in famous artwork than selling stocks or bonds

Private Equity and Venture Capital

Private equity involves investing in private companies or startups not listed on public markets. Historically also reserved for the ultra-wealthy and large institutions, private equity is now increasingly accessible to individual investors through innovative fund structures and fintech platforms.

Pros:

- High return potential: Early-stage investments can yield exceptional gains.

- Diversification: Exposure to private markets unavailable through public exchanges.

- Long-term growth: Their long-term time horizon can align well with retirement timelines.

Cons:

- Liquidity: Funds are typically locked up for years.

- High risk: Many startups fail to generate returns.

- Accreditation: Despite the trend towards increasingly democratized access, many opportunities in private equity remain limited to high-net-worth investors.

Building a Diversified Retirement Portfolio

Although investment diversification is far from new, and has been a cornerstone of well-established approaches such as Modern Portfolio Theory developed in the 1950s, in an increasingly unpredictable world investing wisely across a mix of assets that align with risk tolerance and time horizon is more important today than ever before. Traditional investments can still provide a solid foundation of growth and security, while alternative assets can add valuable diversification and inflation protection. By combining the two, investors can build a portfolio designed to weather unexpected economic shifts and sustain lifestyle into the future. A diversified mix can help grow savings, protect against inflation, and create a comfortable and confident retirement.

Disclaimer: The purpose of this website is education and financial journalism. It is not a recommendation or personalized financial advice. Your personal circumstances have not been taken into account, and this website is not a substitute for consulting a qualified financial advisor. All images are for illustrative purposes only. Past performance is not indicative of future returns.